International Freight Resources

Changes to Customs Handling of Import and Export Declarations – Mandatory Government Changes

Changes to Customs Handling of Import and Export Declarations – Mandatory Government Changes

The UK government has developed a new customs platform known as the Customs Declaration System (CDS). This will replace the existing platform, Customs Handling of Import and Export Freight system (CHIEF). The new system will be linked to your organisation’s Government Gateway account, allowing you to see various aspects of your import and export process for example, pending VAT amounts and outstanding deferment amounts.

Who does it apply to?

Who does it apply to?

All importers and exporters who participate in customs declarations in the UK. CDS registration is mandatory for all importers and exporters. The registration process, which will take around 5 minutes, can be found at: www.gov.uk/guidance/get-access-to-the-customs-declaration-service

To ensure a seamless transaction please register as soon as possible.

When will it start?

– Import declarations will change to CDS after 30th September 2022

– Export declarations will change to CDS after 30th November 2023 (revised deadline)

How will importers & exporters be affected?

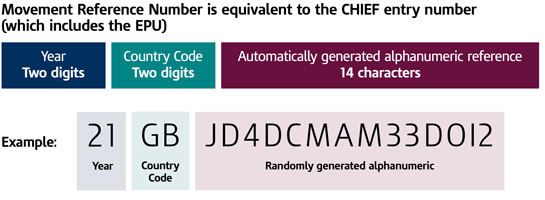

CDS does not generate a C88 or E2 document, both these are now combined into one document generating the Movement Reference Number (MRN). The MRN is a customs identification number that’s created each time a declaration is submitted for importing or exporting goods. The number generated is bespoke, allowing your goods to be uniquely linked to you and as such, it forms an important part of the audit process for your declarations with HMRC.

Additional Useful Quicklinks

For further information on the MRN please follow link below:

https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/930056/8120_CDS_Movement_Reference_Number__MRN__guide_v7_accessible.pdf

HMRC have created various online documents to provide details of the changes and provide assistance they include:

A communication pack detailing key differences between CHIEF & CDS >

HMRC have also made some videos available on how to register for CDS: